Mosi-oa-Tunya: “The gold coin in your pocket”

As inflationary pressures intensify and the economic unease persist, the Monetary Policy Committee (MPC) held a meeting on the 24th of June 2022, and among other things, announced the intended introduction of gold coins by the Reserve Bank of Zimbabwe as a value preservation instrument for investors. Following this resolution by MPC, the Reserve Bank of Zimbabwe on the 4th of July issued a Press Statement to advise the public of the salient features and characteristics of the gold coin which are detailed as follows;

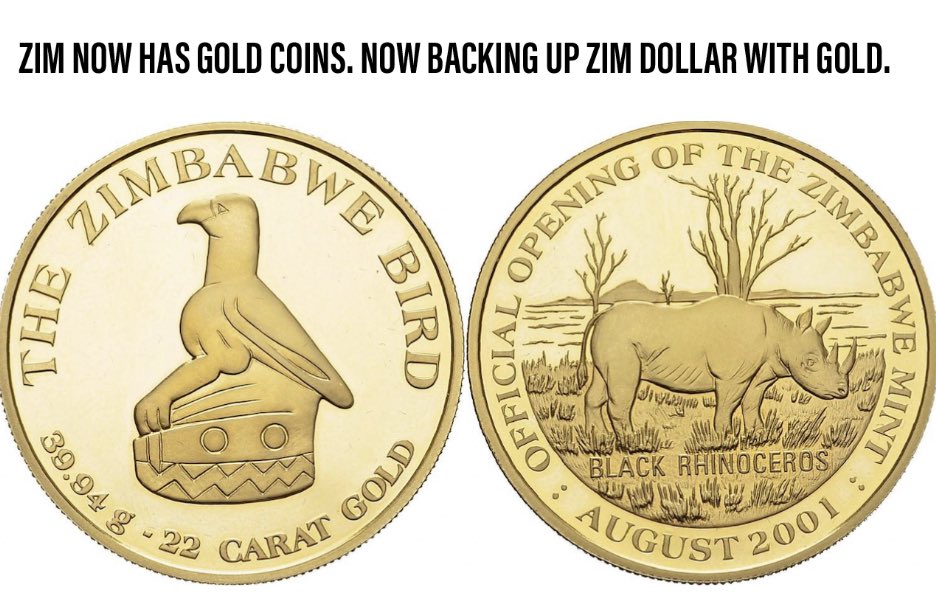

- Each coin will weigh one troy ounce, have a purity of 22 carats and a unique serial number.

- The buyer shall take physical possession of the gold coin upon purchase and be issued with a Bearer Ownership Certificate. The option to hold it or place it in the custody of bankers of own choice will remain in the hands of the buyer or holder. If one opts for a banker, a safe custody certificate or receipt will be issued.

- The gold coin will have a “Liquid Asset Status” meaning the capability of being converted to cash and will be tradeable locally and internationally. The coin may also be used for transactional purposes.

- The gold coin will also have a “Prescribed Asset Status” that allows institutional investors to use it to comply by meeting regulatory requirements for prescribed asset investments.

- The gold coin is also a means of collateral for loans and credit facilities.

- At the instance of the holder, the Bank will buy back the coin.

The coins will be sold through the Bank and its subsidiaries, Fidelity Gold Refinery (Private) Limited and Aurex (Private) Limited, local banks and selected international banking partners. Entities selling the coins shall be required to apply the Know Your Customer (KYC) principles. One will be able to buy the gold coin in both local currency (ZW$) and United States Dollars (US$), including other foreign currencies and in order to determine the price of the gold coin, the cost of production and the international price of gold shall be applied. As the nation waits eagerly for the 25th of July when the gold coin will be available for sale to the public, the question that many are asking is: What impact will the gold coin have on the overall economic market dynamics? As we derive inspiration from its name, will it be The Smoke That Thunders? We wait and see. For now and if we are to benefit, we research further to understand the language of gold and its trading thereof.