Zimbabwe is working towards adopting the Zimbabwe Gold (ZiG) as its sole legal tender by 2030, signaling a bold journey toward monetary stability and economic sovereignty.

‘What’s built to last will not shake with the wind. ZiG means business. Like a rock shaped over time, a year later our own currency is taking a strong, stable, and sure form, holding the line with the power to shape tomorrow.‘ read a statement on the latest RBZ campaign

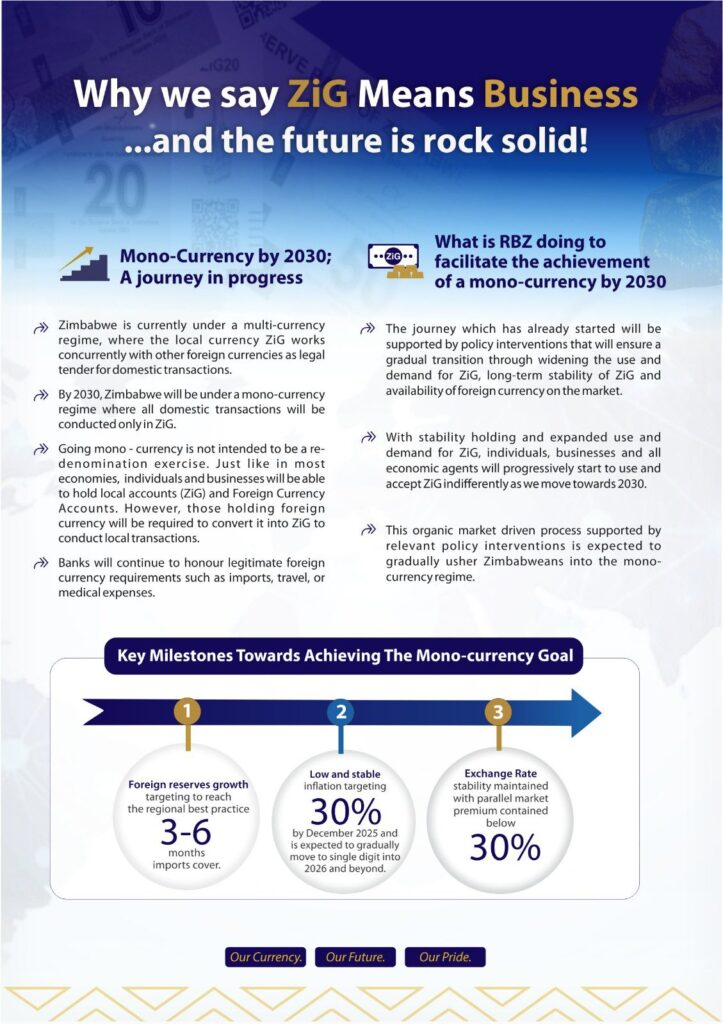

Currently operating under a multi-currency system, Zimbabwe allows ZiG to work alongside foreign currencies for domestic transactions. However, the Reserve Bank of Zimbabwe (RBZ) has outlined a roadmap that will see all domestic transactions conducted exclusively in ZiG within the next five years.

According to the RBZ, the transition to a mono-currency is not a redenomination exercise but a progressive, policy-driven process. Individuals and businesses will still be able to hold both ZiG and Foreign Currency Accounts. However, those holding foreign currency for local transactions will be required to convert it into ZiG. Foreign currency will still be honoured for legitimate needs such as imports, medical expenses, and travel.

The RBZ is implementing measures to support the gradual shift, focusing on expanding the use and demand for ZiG, ensuring its long-term stability, and maintaining access to foreign currency. The aim is to build confidence and encourage individuals, businesses, and economic agents to adopt ZiG more widely in the years ahead.

The central bank emphasizes that the process will be organic and market-driven, backed by relevant policies to usher the economy into a sustainable mono-currency regime.

Three major targets have been set to guide the transition:

- Foreign reserves growth: Building import cover of 3–6 months, aligning with regional best practices.

- Inflation targeting: Keeping inflation at around 30% by December 2025, with a gradual reduction to single digits from 2026 onwards.

- Exchange rate stability: Maintaining the premium between official and parallel market rates below 30%.

The RBZ is confident that these measures will strengthen Zimbabwe’s economic resilience, safeguard stability, and reinforce ZiG’s role as the backbone of national transactions.

With the theme “Our Currency. Our Future. Our Pride.”, the shift toward a mono-currency is positioned not only as an economic reform but also as a cornerstone of Zimbabwe’s sovereignty and long-term growth strategy.