Zimbabwe’s Finance Minister, Professor Mthuli Ncube, presented the 2025 National Budget on 28 November 2024 under the theme “Building Resilience for Sustained Economic Transformation.” The document outlines measures aimed at addressing persistent economic challenges, with a focus on inflation control, currency stability, and infrastructure development.

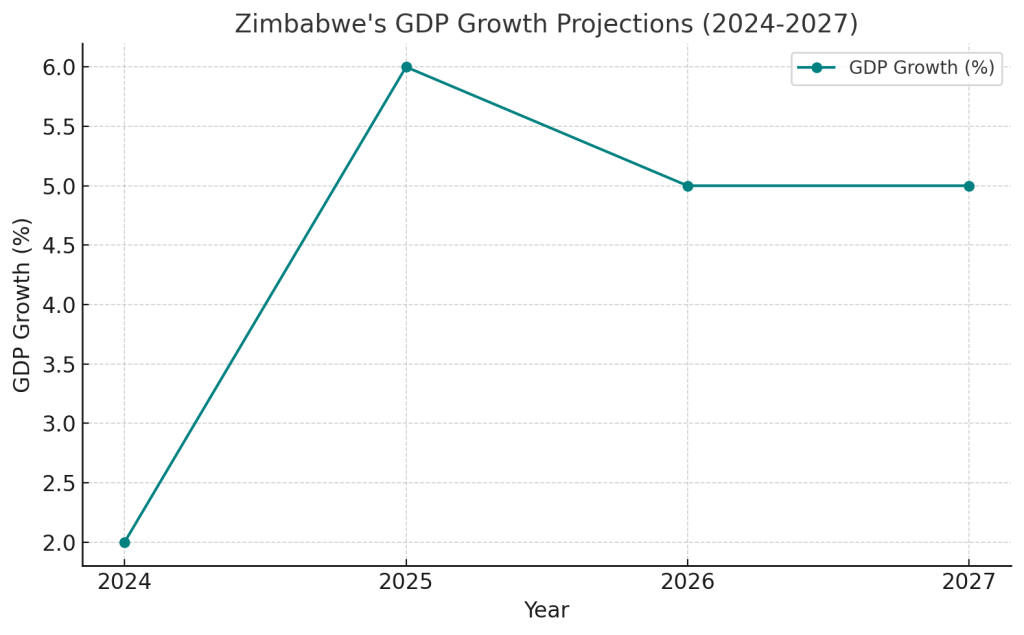

The government forecasts a GDP growth rate of 6% for 2025, driven by projected recoveries in agriculture (12.8%), electricity generation (10.6%), and mining (5.6%). While these figures indicate optimism, they reflect inherent vulnerabilities. Agriculture’s anticipated recovery depends heavily on favourable La Niña rains, while electricity generation hinges on reforms to attract private investment. Mining, too, remains exposed to fluctuating global commodity prices, particularly in gold and tobacco, which form the backbone of export earnings.

The introduction of the Zimbabwe Gold (ZiG) currency in April 2024 has been highlighted as a stabilising force. Initially pegged at US$1: ZiG13.5, the currency depreciated to US$1: ZiG24.88 by October but has since stabilised. The government credits this to tightened monetary policies and reserve-backed stability measures. Inflation has also moderated, with month-on-month rates expected to remain below 3% in 2025. However, this monetary framework demands sustained foreign reserve accumulation, which currently stands at US$540 million, a significant improvement but still modest relative to the economy’s import requirements.

Export earnings, primarily driven by gold and tobacco, are forecast to increase by 6.3% in 2025 to reach US$7.9 billion. This projection is grounded in recent performance, with gold export receipts rising by 16.7% during the first nine months of 2024 due to higher production and global prices. However, subdued performance in platinum group metals (PGMs) and lithium exports highlights Zimbabwe’s reliance on a narrow commodity base. Meanwhile, diaspora remittances, expected to exceed US$2.5 billion in 2025, continue to play a critical role in shoring up the current account.

Domestically, the budget allocates significant resources to infrastructure development, particularly in energy, transport, and water systems. These investments aim to address long-standing bottlenecks that have hampered productivity. For instance, reforms to incentivise private sector participation in electricity generation are intended to mitigate load-shedding, a recurrent issue undermining economic activity. The emphasis on road and irrigation projects is also commendable, given their potential to enhance connectivity and agricultural output. However, past delays in project implementation warrant scrutiny, as the budget largely relies on similar infrastructure promises made in previous years.

The government’s fiscal strategy continues to focus on tightening monetary policies and enhancing revenue collection. The ZiG’s reserve-backed model has been presented as a solution to anchor inflation expectations and restore confidence in the currency. Yet, the depreciation of the ZiG within months of its introduction reflects the delicate balance the government must maintain. Monetary authorities have implemented measures to stabilise the exchange rate, including limiting foreign currency outflows, but challenges persist.

Social spending receives notable attention in the budget. Financial inclusion initiatives have expanded, with loans to women and youth increasing significantly over the past year. For example, loans to women grew from 4.48% of total bank lending in September 2023 to 9.86% by September 2024. Similarly, loans to youth increased from 3.29% to 6.75% over the same period. While these efforts represent progress, broader structural issues, such as high unemployment and limited access to capital for small enterprises, remain unresolved.

Education, Social Protection, and Financial Inclusion from 2023 to 2025.

Public debt remains a significant challenge, constraining fiscal space for critical expenditures. The government’s Arrears Clearance and Debt Resolution process is expected to reduce debt servicing costs, but its pace has been slower than anticipated. External debt, in particular, continues to weigh heavily on the economy, with limited headway in re-engaging with international creditors.

From a structural perspective, Zimbabwe’s economy faces persistent risks. Agriculture, while a key driver of GDP and employment, is highly vulnerable to climate shocks. The reliance on mining for foreign currency earnings makes the economy susceptible to commodity price fluctuations. Manufacturing and other value-added sectors, meanwhile, remain underdeveloped, limiting the potential for economic diversification.

The budget’s assumptions of external stability and global economic recovery are also worth examining. According to the International Monetary Fund (IMF), global growth is projected to remain subdued at 3.2% in 2025, with advanced economies like the European Union and the United States growing at slower rates. Given Zimbabwe’s reliance on external trade and investment, any global downturn could undermine the optimistic export and GDP projections outlined in the budget.

The introduction of the ZiG, while stabilising inflation in the short term, is not without risks. Its reserve-backed model hinges on the availability of foreign reserves, and any depletion could lead to further depreciation. The rapid erosion of the ZiG’s value shortly after its launch underscores the fragility of the system. Additionally, while monetary tightening has curbed inflation, it may inadvertently stifle private sector investment if credit conditions remain restrictive.

The social dimensions of the budget deserve particular attention. Expanding financial inclusion and empowering marginalised groups align with global development priorities. However, these efforts must translate into meaningful economic participation for youths, women, and small businesses. High unemployment rates and limited industrial growth highlight the need for labour-intensive policies in sectors such as manufacturing and tourism.

In conclusion, Zimbabwe’s 2025 National Budget represents a calculated effort to balance immediate economic challenges with long-term development goals. Its emphasis on stabilising the macroeconomic environment through disciplined monetary policies and infrastructure development is commendable. However, the reliance on external factors, such as favourable rains and commodity price stability, exposes the economy to significant risks. Furthermore, while social spending and financial inclusion have improved, deeper structural reforms are necessary to address unemployment and broaden economic opportunities.

Ultimately, the budget reflects a government striving to stabilise an economy long marked by volatility. The success of these measures will depend on disciplined implementation, sustained foreign reserve accumulation, and the ability to adapt to both domestic and global economic pressures. Zimbabweans will be watching closely to see if these promises lead to tangible progress or fall into the pattern of unfulfilled aspirations that have characterised previous budgets.